Can Trump fire Fed chairman Jerome Powell? This question has been at the forefront of discussions surrounding the former president’s contentious relationship with the Federal Reserve and its leadership. While Trump initially appointed Powell to his position in 2017, his frustrations over the Fed’s monetary policies have led to speculations about Powell’s potential removal. Analysts warn that such a decision could jeopardize the independence of the Fed and trigger significant market reactions, reflecting the economic impact of having a politically influenced central bank. The ongoing debate raises critical considerations about the delicate balance between presidential authority and the importance of maintaining a stable economic environment, particularly in light of the recent volatility in the markets.

The intriguing possibility of Trump being able to dismiss the chairman of the Federal Reserve has sparked widespread debate among economists and politicians alike. Discussions often revolve around the independence of the Fed, especially in times when the presidential powers may seem to extend into traditionally neutral territories. The Federal Reserve chair’s removal could have profound implications for market confidence and the prevailing economic climate. Moreover, the anticipation of how the markets react to this potential shift reveals the nuanced relationship between a president’s decisions and the financial health of the nation. Understanding the complexities of such an act requires delving into the broader dynamics of monetary policy, executive authority, and their intertwined effects on economic stability.

Can Trump Fire Federal Reserve Chairman Powell?

The question of whether President Trump can fire Federal Reserve Chairman Jerome Powell is complex and nuanced. While the Federal Reserve Act allows for the removal of governors for cause, the language surrounding the chairperson’s position is less clear. The act does not explicitly state conditions for firing the chair, which raises questions of presidential power versus the institutional independence of the Fed. This legal ambiguity becomes especially relevant given Trump’s contentious relationship with Powell over interest rates and economic forecasts. Despite express thoughts about firing Powell, Trump’s administration has repeatedly stated that such a decision is not currently in the plans, likely due to potential disruption in financial markets.

Moreover, the implications of attempting to fire the Fed chair would likely reverberate through the economy. Financial markets depend on the perceived independence of the Federal Reserve to bolster confidence in monetary policy and economic stability. If Trump pushed for Powell’s removal, analysts predict a market backlash that could lead to increased volatility and skepticism about the Fed’s direction. The legal and economic ramifications of this action could compromise the long-standing independence of the Federal Reserve, which is designed to insulate monetary policy from political pressure.

The Economic Impact of a Fed Chair Removal

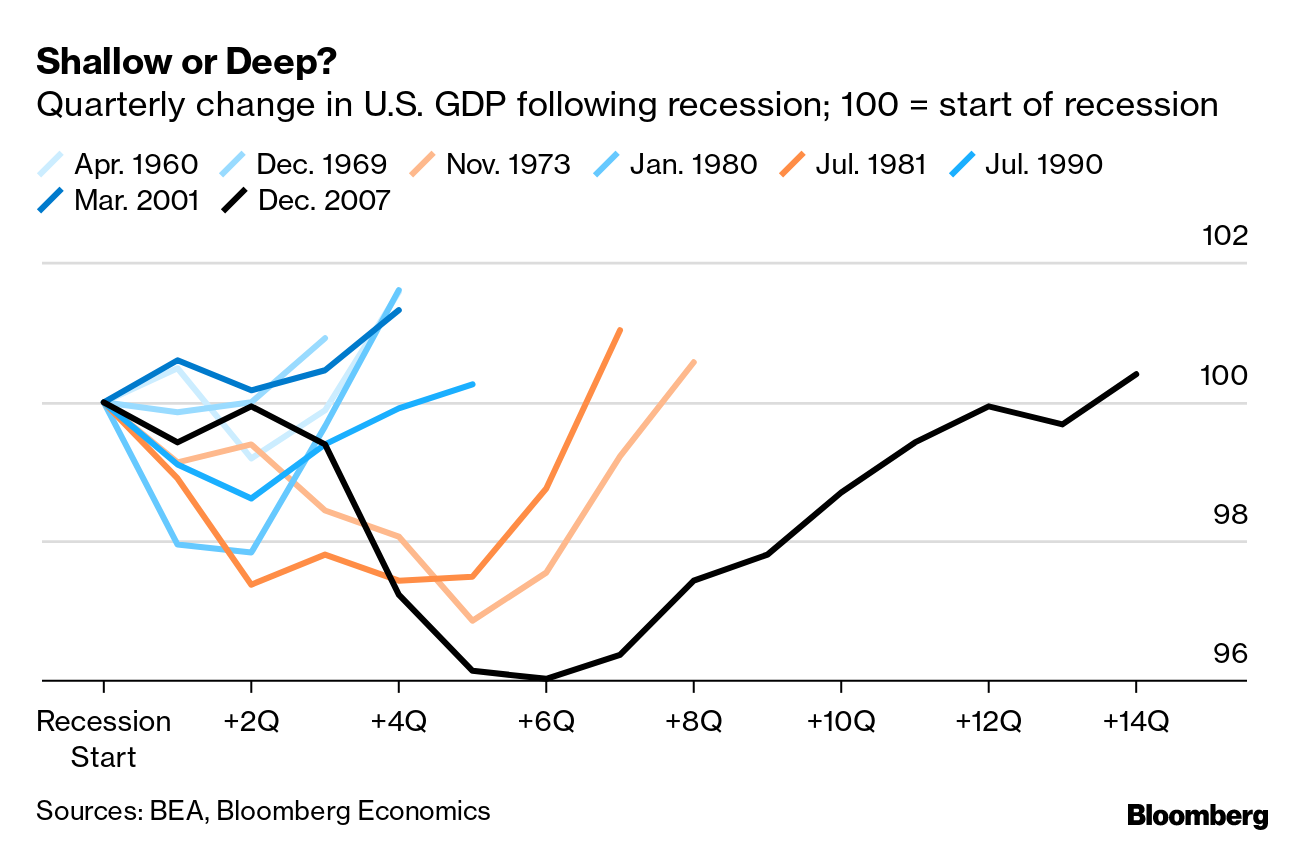

Removing the Federal Reserve chair has the potential for significant economic repercussions. Markets react strongly to changes in leadership at the Fed, as the central bank’s policies directly influence inflation rates, interest rates, and overall market sentiment. If Trump were to remove Powell, it could signal a shift toward more aggressive monetary policy aimed at stimulating economic growth, which may initially seem favorable. However, the long-term impact could be detrimental. Markets could interpret the action as an attempt to undermine the Fed’s credibility, leading to increased inflation expectations—possibly causing a rise in long-term interest rates due to heightened risk.

Additionally, such a move could reflect a broader trend of diminishing the Fed’s independence, raising the stakes of political influence on economic policy. A lack of stability and confidence in the central bank’s decision-making process may discourage investment and savings, which are vital for economic growth. This tension between political oversight and economic policy highlights the delicate balance that must be maintained to support a healthy economy, further complicating the decision-making landscape for lawmakers and economic advisors.

Market Reactions to Trump vs. Powell Dynamics

The relationship between President Trump and Fed Chairman Jerome Powell has become a focal point for market analysts and investors alike. Observers note that Trump’s public criticism of Powell over interest rates adds an unpredictable element to financial markets, fostering an environment of uncertainty. This unpredictability can lead to market fluctuations, as traders adjust their positions based on perceived implications of the president’s statements and actions. For instance, when Trump expressed dissatisfaction with Powell, indicators such as stock prices and bond yields exhibited increased volatility, signaling traders’ concerns about the Fed’s ability to operate independently.

Moreover, markets thrive on predictability, and Trump’s aggressive stance towards Powell has resulted in nervousness among investors. Concerns over potential policy changes or leadership shakeups at the Fed can create a ripple effect, leading to heightened risk premiums in equity and debt markets. Investors may react by moving towards safer assets, causing significant shifts in the market landscape. Overall, the interplay between Trump’s actions and Powell’s responses shapes not only market confidence but also broader economic conditions.

The Independence of the Fed Under Political Pressure

The Federal Reserve’s independence is a cornerstone of U.S. monetary policy, designed to shield it from political pressures that could influence economic stability. This independence allows the Fed to make decisions based on economic data rather than political considerations, promoting long-term welfare over short-term political gains. However, Trump’s contentious relationship with Jerome Powell has raised concerns about the future of this independence. Critics argue that if the president were to exert pressure on Powell or attempt to remove him, it could set a precedent that undermines the Fed’s ability to function free from political influence.

The historic precedent for the Fed’s independence raises questions about the implications of a politically motivated removal of its chair. If Trump were to succeed in firing Powell, it might encourage future administrations to view the Fed as a tool for political strategy rather than a separate entity tasked with maintaining economic stability. This could erode public trust in the Fed, with long-term consequences such as diminished effectiveness in managing inflation and stabilizing economic crises. Ultimately, preserving the independence of the Federal Reserve is critical to sustaining economic confidence and ensuring prudent monetary policy.

Legal Arguments Regarding Fed Chair Removal

Delving into the legalities surrounding the potential removal of Jerome Powell reveals complexities that intertwine statutory interpretation and constitutional authority. The Federal Reserve Act provides limited guidance about the removal of the chair, leading to interpretations that could either protect Powell from dismissal or allow the president greater discretion. The Supreme Court’s stance on executive authority and independent agencies will likely be pivotal if a challenge arises. Recent decisions have begun to blur the lines of perceived protections, leading legal scholars to debate whether the historical interpretations of ‘for cause’ removal prevail in contemporary contexts.

If Trump were to attempt to remove Powell, the legal disputes that would follow could take years to resolve. This protracted uncertainty would likely magnify market reactions and undermine the confidence that investors place in government institutions. Additionally, courts may view the Fed’s unique role differently than they do for standard executive agencies, which complicates the discourse on whether the Federal Reserve chair can be dismissed without cause. The outcome of such litigation could redefine the parameters of federal authority and the independence of economic institutions altogether.

Consequences of Political Pressure on Fed Decisions

Political pressure can have profound consequences on the functioning of the Federal Reserve, especially when it comes to policy decisions. The inherent risk in applying such pressure is that it may lead to short-term gains at the expense of long-term economic health. If the Fed is perceived as bending to political will, it risks losing credibility, which could have lasting effects on its effectiveness in managing inflation and employment levels. For instance, if markets believe the Fed may prioritize political objectives over economic indicators, it can lead to a lack of confidence in monetary policy decisions.

Furthermore, when the central bank is suspected of acting under political influence, it may prompt investors to adjust their strategies by seeking safer investments, leading to increased volatility in bond and equity markets. The resulting uncertainty can stifle economic growth, as businesses become hesitant to invest in an unpredictable climate. Ultimately, maintaining the Fed’s independence is paramount to ensuring it can act judiciously, even amidst political turmoil, to uphold economic stability and foster growth.

The Role of the Federal Reserve Chair in Policy Making

The chair of the Federal Reserve holds a critical role in shaping monetary policy and guiding the direction of the U.S. economy. Unlike a traditional CEO, the Fed chair operates within a framework that requires consensus and collaboration with other committee members, often leading to deliberative and carefully considered decisions. While the chair is a prominent figure who often represents the Fed’s communications, the real power is distributed across the Board of Governors and the Federal Open Market Committee (FOMC). This structure is designed to provide checks and balances that mitigate the effects of any single individual’s biases or political pressures.

The influence of the Fed chair extends beyond simple policy decisions to encompass the broader realm of economic expectations. The chair’s statements and actions can set the tone for market behaviors and inform both investor decisions and public perception. Therefore, the appointment of a new chair holds significant implications, not only regarding immediate policy shifts but also concerning the long-term credibility of the Federal Reserve. Investors and economists alike closely monitor the dynamics between the chair and the administration, as this relationship can provide insight into future policy approaches and the Fed’s commitment to maintaining its independence.

Potential Successors to Powell and Market Expectations

Speculation about potential successors to Jerome Powell has become commonplace as discussions around his tenure heat up. Markets are acutely aware that any change in leadership can trigger significant adjustments in monetary policy. While Powell’s policies are often regarded as moderate, the identity of his successor could push for either more aggressive or conservative monetary strategies. Therefore, who the president might nominate as a successor holds weight beyond the individual’s qualifications, reflecting broader implications for economic direction and financial stability.

Moreover, if Powell were ultimately to be replaced, market analysts would likely scrutinize the nominee’s previous stances on interest rates and inflation to gauge potential future actions. A nominated chair with a reputation for favoring aggressive stimulus measures, for instance, could lead to heightened concerns about inflation, causing immediate shifts in investor sentiment. Thus, market jitters surrounding Powell’s potential removal are not solely related to the act itself but are deeply intertwined with the anticipated monetary policies of his potential successor, emphasizing the Fed’s pivotal role in the economic landscape.

Frequently Asked Questions

Can Trump fire the Fed chairman Jerome Powell?

While President Trump has hinted at the possibility of firing Federal Reserve Chairman Jerome Powell, legal experts suggest that such a move could undermine the independence of the Federal Reserve. The Federal Reserve Act states that the chair can only be removed for cause, which raises questions about the legality of a dismissal. Moreover, any attempt to fire Powell might lead to significant market reactions, influencing the president’s decision.

What is the relationship between Trump and Jerome Powell in terms of Federal Reserve chair removal?

President Trump and Jerome Powell have had a tumultuous relationship, with Trump often publicly criticizing Powell’s decisions and monetary policy. Trump has expressed dissatisfaction with Powell for not lowering interest rates aggressively enough. However, firing Powell could jeopardize the Federal Reserve’s independence and could backfire politically and economically, making such a removal unlikely.

What could be the economic impact if Trump fires the Federal Reserve chair?

If Trump were to fire Jerome Powell, the economic impact could be significant, leading to increased market volatility. Investors may fear that the removal would lower the credibility of the Federal Reserve and lead to a more accommodative monetary policy, potentially resulting in inflation concerns and rising long-term interest rates.

How would the market react to a potential Trump Powell removal?

The market is likely to react negatively to the potential ousting of Jerome Powell, as it may signal instability within the Federal Reserve. Investors generally desire a stable and independent central bank to maintain economic confidence. Any indication of political interference could lead to increased uncertainty and higher premiums on long-term debt.

What is the importance of the independence of the Fed in relation to Trump’s actions?

The independence of the Federal Reserve is crucial to maintaining economic stability and public trust in monetary policy. If Trump were to attempt to fire Jerome Powell, it could be viewed as a direct threat to this independence, raising concerns about the Fed’s ability to make objective decisions free from political pressure.

Is it legally feasible for Trump to remove the Fed chairman?

The legality of Trump removing Federal Reserve Chairman Jerome Powell is complex. While the Federal Reserve Act allows for governors to be removed for cause, it does not explicitly provide a straightforward basis for the removal of the chair. This ambiguity could lead to a legal challenge if such an action were attempted.

What are the potential consequences for the Federal Reserve if Powell is removed by Trump?

If Powell is removed, the Federal Reserve could face a credibility crisis. Markets may become wary of the Fed’s future policies, fearing a shift towards more politically motivated monetary actions. This could result in alterations to inflation expectations and economic forecasts, contributing to further volatility.

How much authority does the Fed chair have in practice?

The Fed chair plays a significant role in shaping monetary policy, but they do not act unilaterally. The chair must work collaboratively with the Federal Open Market Committee (FOMC) to build consensus. While they hold a prominent position, the chair’s influence is balanced by the views of other committee members.

Could appointing a new chair calm market fears relating to Trump’s influence?

While appointing a new chair may initially assuage some market fears, the mere act of replacing Jerome Powell would suggest uncertainty and possible changes in monetary policy direction. Investors often interpret such moves through the lens of potential future policy adjustments, and the identity of the successor would significantly matter.

What are the constitutional implications of Trump’s potential removal of the Fed chair?

The constitutional implications of Trump’s potential removal of Jerome Powell hinge on the interpretation of executive authority over independent agencies. Recent Supreme Court rulings suggest a narrowing of the ‘for cause’ removal protections historically granted to heads of independent agencies like the Federal Reserve, which complicates the constitutional framework surrounding such an action.

| Key Point | Details |

|---|---|

| Trump’s Relationship with Powell | Trump appointed Powell in 2017 but has criticized him for not supporting aggressive interest rate cuts. |

| Legal Authority | The Federal Reserve Act allows governors to be removed for cause, but it is unclear if this applies to the FOMC chair. |

| Supreme Court Influence | Recent decisions suggest potential erosion of protections for independent agency heads, including possible distinctions for the Fed. |

| Market Reactions | Firing Powell could lead to instability in financial markets due to loss of Fed independence and potential policy shifts. |

| Future Implications | Analysts suggest that market reactions may dissuade Trump from removing Powell before his term ends, in order to maintain stability. |

| Appointment of Successor | If Powell is retained, the identity of his successor will be key for market confidence once his term is over. |

Summary

Can Trump fire Fed chairman? The legal landscape regarding the president’s ability to remove Federal Reserve Chairman Jerome Powell is complex and intertwined with both statutory interpretations and recent Supreme Court decisions. While the Federal Reserve Act allows for the removal of governors ‘for cause,’ the specific protections for the chair are ambiguous. Analysts caution that any attempt to oust Powell could lead to significant market volatility, undermining the Fed’s independence and credibility. Consequently, the consensus among experts suggests that such a move is unlikely, especially given the potential negative repercussions on financial markets.