The impact of research funding has become increasingly evident as institutions navigate financial uncertainties, particularly within the context of U.S. economic growth. With significant cuts like those at Harvard posing a threat to the continuity of scientific innovation, the ramifications extend far beyond academia. Such funding is not merely a financial resource; it’s a catalyst for entrepreneurship disruption, essential for nurturing new startups that drive economic vitality. Recent analyses highlight that every dollar invested in federal research funding generates a staggering $2.56 in economic activity, underscoring the critical link between research support and the thriving startup ecosystem. As we delve deeper into the consequences of diminished funding, it becomes clear that protecting these vital financial channels is imperative for the health of our nation’s economy.

The landscape of financial support for academic research plays a pivotal role in shaping tomorrow’s innovations and startup ventures. Funding mechanisms are crucial for fostering entrepreneurship and accelerating the transition from groundbreaking ideas in labs to market-ready products. As institutions like Harvard face cuts, a growing concern emerges regarding the stability and future success of the entrepreneurial framework that relies on such support. Understanding the importance of financial investment in research not only highlights the relationship between federal grants and technological advancements but also emphasizes the broader implications for national economic development. The vibrancy of the startup ecosystem hinges on the availability of research funding, reflecting the interconnected nature of education, innovation, and economic prosperity.

The Importance of Research Funding in the Startup Ecosystem

Research funding is a critical component underpinning the startup ecosystem, particularly in technology and biomedical fields. The financial resources provided through federal grants and university funding serve as a vital lifeblood for innovation, allowing research institutions to operate cutting-edge laboratories and develop novel ideas. These facilities, like Harvard’s Wyss Institute and Broad Institute, foster an environment where academic research can translate into breakthrough products and services, ultimately leading to the creation of new companies. The interconnectedness of academic research, entrepreneurship, and the startup ecosystem is essential for driving U.S. economic growth.

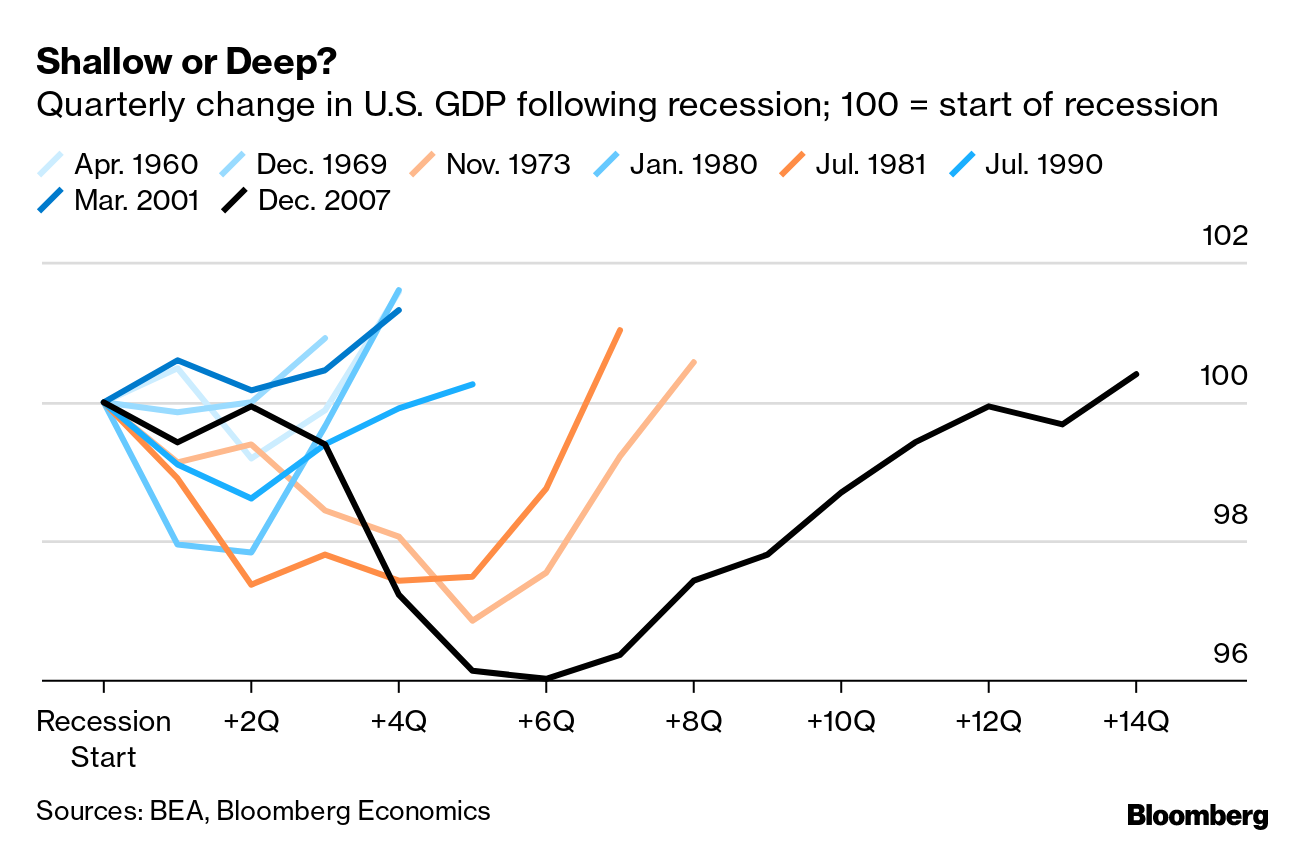

When research funding is cut, the repercussions resonate throughout the entire ecosystem. Startups, which often rely heavily on technological advancements stemming from university research, may face significant challenges in obtaining the foundational knowledge and innovations necessary for their success. According to economists, even moderate cuts to research funding could shrink the GDP by a substantial margin, mirroring the effects seen during the Great Recession. The predictive models suggest that a healthy influx of research funding correlates directly with a robust startup landscape, highlighting the need for sustained investment in scientific research as a cornerstone of economic vitality.

How Harvard’s Funding Cuts Could Disrupt Innovation

Recent funding cuts at Harvard due to political disagreements have raised alarms about the potential disruption it could have on innovation. With more than $2 billion of federal research funding frozen, many fear the halt in project support will hinder the groundbreaking research that drives social and economic progress. Schools like Harvard are not just centers for education; they are incubators for entrepreneurial ideas that often lead to startups that contribute to innovation and economic expansion. This funding freeze could lead to a chilling effect on the environment that nurtures emerging entrepreneurs, critically undermining the innovation pipeline.

Moreover, the impact is likely to extend beyond immediate funding. As the creation pipelines for new companies become stymied, it may result in a significant slow down in the number of startups that leverage this research into viable products and services. The ripple effects of such disruptions can take years to materialize, as ideas cultivated today may take years to develop into commercially viable enterprises. This latency means that the detrimental impact on entrepreneurship could linger long after research funding is restored, potentially giving rise to a generation of missed opportunities within the U.S. economy.

The Role of Universities in Fostering Entrepreneurship

Universities play a pivotal role in fostering entrepreneurship by bridging the gap between theoretical research and practical application. Institutions like Harvard provide not only an abundance of resources but also a culture that encourages risk-taking and innovation. With a focus on entrepreneurship, universities equip students and faculty with the necessary tools and knowledge to transform research ideas into marketable products. The strong network of venture capitalists and entrepreneurs associated with such institutions amplifies this effect, ensuring that innovations find their way into the startup ecosystem.

In the current climate, where federal research funding is under threat, the incubation role of research universities could diminish significantly. Students, motivated by a rich curriculum centered on entrepreneurship, could find their projects derailed due to a lack of access to research resources. The confluence of education, mentorship, and funding opportunities at universities is crucial for nurturing the next generation of entrepreneurs, and any disruption in this environment could hinder the development of new ideas and technologies that form the backbone of U.S. economic growth.

The Long-Term Consequences of Federal Funding Freezes

The long-term consequences of federal funding freezes can be staggering. Without the steady flow of research grants, institutions may experience a decline in innovation, as researchers face limitations in their ability to conduct experiments, hire staff, and explore new projects. Particularly in high-stakes fields like medicine and technology, these cuts pose a significant threat to the discovery and development of new treatments and technologies that could potentially save lives and improve quality of life for many Americans. The initial impacts may seem abstract, but as time progresses, the absence of research-led innovation could translate into tangible setbacks for the economy.

Moreover, the halt of previously approved NIH grant payments suggests that an entire generation of scientific inquiry is at risk. This can lead to a stagnation within fields that depend on progressive research efforts. As startups harness the momentum provided by innovative breakthroughs, a decline in the pipeline of new ideas could mean fewer opportunities for ambitious entrepreneurs to establish ventures. Thus, while immediate effects may not be evident, the potential loss of groundbreaking research and entrepreneurial activity could profoundly reshape the landscape of U.S. economic growth in the years to come.

Balancing Risk and Opportunity in Entrepreneurship

In the context of funding cuts and reduced research support, it’s crucial to strike a balance between risk and opportunity in entrepreneurship. Entrepreneurs often thrive in dynamic environments where they can experiment and innovate. However, when research funding is curtailed, the opportunities for experimentation diminish, which can lead to a more cautious approach among budding entrepreneurs. The Harvard curriculum emphasizes transforming risk into opportunity by equipping students with the skills and knowledge to generate viable business ideas.

By fostering an environment that embraces innovation and calculated risk-taking, universities can help students navigate the changing landscape of entrepreneurship. When federal research funding is robust, the opportunities for students to engage with practical projects and gain hands-on experience significantly increase. Unfortunately, funding cuts can undermine this very foundation, diminishing the entrepreneurial spirit and possibly erasing some of the critical components that contribute to successful ventures in the startup ecosystem.

Connecting Academic Research to Real-World Applications

The connection between academic research and real-world applications is vital for ensuring that innovative ideas transition into successful products and services. Research universities serve as a bridge, helping to translate theoretical knowledge into practical solutions that can be commercialized. Institutions like Harvard are at the forefront of this process, where high-quality research informs the development of startups and technological advancements. As innovations emerge from labs, they often require the entrepreneurial spirit fostered within universities for successful implementation and market entry.

In a scenario where research funding is threatened, the pathway from academia to the marketplace could see significant disruptions. This creates a gap between research initiatives and their commercial potential, stifling economic growth and limiting the startup ecosystem’s dynamism. A robust system of research funding encourages a seamless transition from scientific inquiry to real-world impact, which is crucial for fostering an environment where entrepreneurship can flourish.

Fostering Collaboration Between Universities and Startups

Collaboration between universities and startups is essential for revitalizing the entrepreneurial ecosystem and driving economic growth. By bringing together academic research and entrepreneurial vision, these partnerships can facilitate the translation of innovative ideas into viable business models. Universities can serve as a source of talent and innovation while startups can provide a practical outlet for academic research. This collaboration not only enriches the educational experience for students but also stimulates the local and national economy.

However, the current federal funding freeze poses a challenge to this collaboration. As research grants are restricted, the resources available for joint ventures between universities and startups are reduced. This could result in a decline in the number of successful collaborations, ultimately limiting the entrepreneurial landscape and reducing the pipeline of emerging companies. A healthy exchange of ideas and resources is vital for ensuring that research translates into commercial success and that the startup ecosystem remains vibrant.

The Challenges Ahead for Future Entrepreneurs

The future of entrepreneurship looks increasingly precarious in light of the current challenges facing research funding. Aspiring entrepreneurs depend on a continuous flow of innovative ideas that arise from academic research, and without adequate funding, the potential for innovation diminishes. This creates hurdles for new ventures seeking to harness the latest technological advancements or benefit from novel research insights. As the funding landscape shifts, future entrepreneurs may find it increasingly difficult to access the resources necessary to launch and sustain their businesses.

As institutions face uncertainties surrounding their funding, the drive to innovate and commercialize new concepts may be hindered. Additionally, the entrepreneurial mindset nurtured within universities could see a decline if students feel discouraged by the lack of support from research funding. Addressing these challenges will require a concerted effort from both the academic and entrepreneurial communities, ensuring that the critical connection between research and the startup ecosystem remains intact for future generations.

The Impact of Innovation on Economic Growth

Innovation plays a crucial role in driving economic growth, and the link between research funding and innovation is undeniable. Investment into research not only leads to technological advancements but also generates new market opportunities and industries. The ongoing support for federal research initiatives is paramount to sustaining this growth trajectory, particularly in an era where entrepreneurship is a major driver of economic vitality. The arrival of invested capital into high-research areas can lead to groundbreaking developments that stimulate job creation and overall economic improvement.

Cutting research funding can have debilitating effects on the innovation landscape, leading to a slowdown in economic growth. As the potential for emerging technologies is hindered, the spillover effects could mean fewer advancements reaching commercial viability. The research conducted today sets the stage for future innovations that can transform industries, and therefore, maintaining robust support for research funding is essential for preserving the foundations of U.S. economic growth in a competitive global arena.

Frequently Asked Questions

What is the impact of research funding cuts on U.S. economic growth?

Cuts to research funding can severely impede U.S. economic growth. According to research, even a small reduction in funding could shrink GDP by up to 3.8%, analogous to the economic downturn during the Great Recession. Research funding fuels innovation, which is critical for maintaining competitive advantages in a global economy.

How do federal research funding and entrepreneurship influence each other?

Federal research funding acts as a catalyst for entrepreneurship by providing the resources needed to transform innovative ideas into commercial ventures. When funding is strong, it promotes extensive research and development, yielding startups that drive job creation and economic development within the U.S. startup ecosystem.

What are the consequences of Harvard funding cuts on the startup ecosystem?

Harvard funding cuts can disrupt the startup ecosystem by limiting resources for research and reducing the number of innovative companies emerging from the university. Startups often rely on cutting-edge research and talent that thrives in well-funded academic environments, and funding freezes can slow this pipeline considerably.

Why is the freeze on federal research funding critical for biomedical innovation?

The freeze on federal research funding poses a significant threat to biomedical innovation as it halts progress in critical research. This can lead to delayed breakthroughs in medicine, reduced hiring in labs, and ultimately fewer startups that commit to developing new healthcare solutions, impacting U.S. economic growth.

How do research funding impacts entrepreneurship education at universities?

Research funding impacts entrepreneurship education by ensuring that top-tier faculty and facilities are available to students. Institutions like Harvard can offer rich entrepreneurship curricula and incubators that produce successful startups, largely due to the availability of financial support for research and development initiatives.

What role do research universities play in fostering entrepreneurship amid funding cuts?

Research universities serve as essential incubators for entrepreneurship. They connect faculty and students with venture capital and resources needed to launch startups. Funding cuts threaten this ecosystem, potentially leading to fewer opportunities for budding entrepreneurs and diminishing the overall impact on U.S. economic advancement.

What are some long-term effects of reduced federal research funding on the economy?

Long-term effects of reduced federal research funding could include a pronounced slowdown in innovation, decreased international competitiveness, and ultimately, an economic contraction. This could manifest in fewer successful startups, job losses in emerging industries, and a diminished capacity for scientific breakthroughs that contribute to U.S. economic growth.

Can federal research funding cuts impact the quality of startups emerging from universities?

Yes, cuts in federal research funding can significantly impact the quality of startups emerging from universities. A reduction in resources can limit the development of innovative concepts, reduce the mentorship available for students and faculty, and ultimately lead to a decline in the number of high-quality startups entering the market.

| Key Topics | Details |

|---|---|

| Current Funding Situation | Harvard has faced a freeze on over $2 billion in research funding due to political tensions. |

| Impact on U.S. Economy | Projected GDP shrinkage of 3.8% if funding cuts persist, similar to recession levels. |

| Startup Ecosystem Connection | Research universities are incubators for startups, linking faculty research with entrepreneurial students. |

| Future of Entrepreneurship | Long-term effects will likely reduce the number of successful startups due to funding cuts. |

| Role of Federal Funding | Essential for performance in labs, driving innovation and attracting top talent. |

Summary

Research funding impact is crucial for maintaining the lifeblood of innovation within the U.S. economy. As federal funding for scientific research faces cuts, the ripple effects threaten not only universities but also the larger startup ecosystem that thrives on these innovations. Without adequate support, the future of entrepreneurship in America could be at stake, leading to a decline in technological advances and economic growth.